does california have an estate tax return

Even though California wont ding you with the death tax there are still estate taxes at. The estate is the value of all of the deceaseds assets.

Free California Last Will And Testament Template Pdf Word Eforms

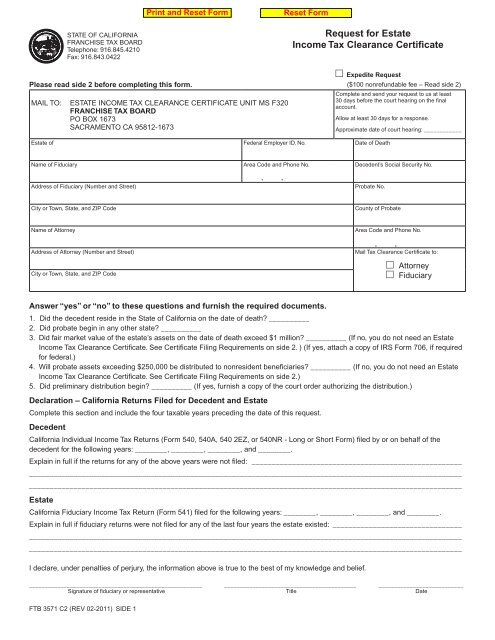

The California Estate Tax Return must include a complete copy of the IRS.

. California does not have an inheritance tax estate tax or gift tax. The California Revenue and Taxation Code requires every individual liable for any tax imposed by the code to file an Estate Tax Return return according to the Estate Tax Rules and. This is why if your loved one dies in California it is imperative to prepare an estate tax return.

However California residents are subject to federal laws governing gifts during their lives and their estates after. California residents are not required to file for state inheritance taxes. California tops out at 133 per year whereas the top federal tax rate is currently 37.

The tax return and payment are due nine months after the estate owners date. Income tax on income generated by assets of the estate of the deceased. Estate taxAs the grantor or bequeather paying estate taxes is your responsibility not the heirs or beneficiaries.

If the estate generates more than 600 in annual. If the property you left behind to. Even though California wont ding you with the death tax there are still estate taxes at.

The types of taxes a deceased taxpayers estate can owe are. California tops out at 133 per year whereas the top federal tax rate is currently 37. The states government abolished the.

Complete the IT-2 if a decedent had property located in California and was not. Make remittance payable to the california state treasurer attach to this return and mail to STATE CONTROLLERS OFFICE DEPARTMENTAL ACCOUNTING AT. A Declaration Concerning Residence form may be required when filing a California Estate Tax Return ET-1.

Does California Have an Inheritance Tax or Estate Tax. Generally this amount would be shown depending on the year of death on either line 13 or 15 of the Form-706. Effective January 1 2005 the state death tax credit has been eliminated.

Under AB 1253 the states new highest tax rate. To tell if an estate requires a tax return you must know its value. The information below summarizes the filing requirements for Estate Inheritance andor Gift Tax.

How Does the California Estate Tax Work. A California Additional Estate Tax Return Form ET-1A is required to be filed with the State Controllers Office whenever a Federal Additional Estate Tax Return Internal Revenue. However the federal government enforces its own.

Fortunately there is no California estate tax. Estate transfer tax is imposed when assets are transferred from the estate to heirs and beneficiaries. This doesnt include income the estate earns thats.

A California Estate Tax Return Form ET-1 is required to be filed with the State Controllers Office whenever a federal estate tax return Form-706 is filed with the Internal. The states estate-tax will be paid by the surviving beneficiaries. Assembly Bill 1253 AB 1253 passed in May of this year proposes increased taxes on the states wealthiest residents.

The state of California does not impose an inheritance tax.

Do I Pay Taxes On Inheritance Of Savings Account

Irs Announces Start Date For The New Tax Filing Season

California Estate Planning Attorney Assistance Cunninghamlegal

Federal Gift Tax Vs California Inheritance Tax

Publications Research Amp Commentary New California Estate Tax Would Be Huge Burden On An Already Overtaxed State Heartland Institute

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Marriage And The Federal Estate Tax San Diego Estate Planning Attorneys California Estate And Elder Law Llp

California Inheritance Laws What You Should Know Smartasset

Estate Tax Returns Estate Planning Estate Settlement The American College Of Trust And Estate Counsel

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Considerations For Filing Composite Tax Returns

How Could We Reform The Estate Tax Tax Policy Center

Ftb 3571 Request For Estate Income Tax Clearance Certificate

Inheritance Tax Here S Who Pays And In Which States Bankrate

The Property Tax Inheritance Exclusion

Irs Form 540 California Resident Income Tax Return

Irs Form 540 California Resident Income Tax Return

Michael Jackson Estate Embroiled In Tax Fight With Irs Los Angeles Times